Payslip 給与明細

WORK’IN JAPAN

05.10.2021

Payslip

When employed, in most companies, employees are paid their salary on a designated payday every month.

Employees receive a “payslip” from the company which contains their salary information. There are many items detailed on the payslip and some foreign nationals may be confused when they see it for the first time, not knowing what is essential. This article will introduce how to read a payslip and the written items in it.

【額面Gakumen (gross salary)and 手取りTedori (after tax)】

In Japan, a system called “Gensen Choshu” (withholding tax) is in place, this means that taxes, such as social insurance premiums and resident taxes, are deducted from the salary before it is paid to an employee’s bank account.

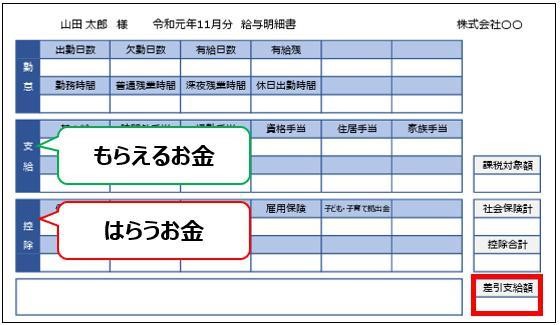

The amount of money paid by the company before deductions is called the “総支給額Soushikyugaku( total amount paid)※ 額面(Gakumen). The deduction of insurance premiums, taxes, etc. from salary in advance is called “天引きTenbiki”. The amount of money that employees receive after the deduction is listed in the “差引支給額 Sashihiki-Shikyugaku (*手取りTedori)” column, and this amount will be transferred to their bank account.

Let’s see the table below.

The above is a sample payslip.

The payslip is divided into the following items: [Attendance], [Payments], and [Deductions]. The total amount of payments is the total amount being paid to the employee, and the total amount of deductions is the amount being deducted.

Let’s take a look at what each item means and how to read it.

※The format of the payslip varies depending on the company. You can refer to the meaning of the terms here and compare your company’s payslip.

■Record of time worked and time off (attendance)

① Number of working days(出勤日数 Syusseki Nissu): Number of working days in the relevant month as determined by the company

② Number of days absent from work(欠勤日数 Kesseki Nissu): Number of days absent from work during the relevant month

③ Number of days of paid leave(有給日数 Yukyu Nissu): Number of paid leave days taken

④ Number of days of paid leave remaining: (有給残 Yukyu Zan): Number of days of paid leave remaining at the end of the relevant month

⑤ Working hours(勤務時間 Kinmu Jikan): Hours worked in the relevant month

⑥ Regular overtime hours(普通残業時間 Futsu Zangyo Jikan): Overtime work in excess of the working hours stipulated in the employment contract

⑦Late night overtime hours(深夜残業時間 Shinya Zangyo Jikan): Working hours between 10:00 p.m. and 5:00 a.m.

⑧Working hours on holidays(休日出勤時間 Kyujitsu Syukkin Jikan): Overtime work on legal holidays

■The total amount of payments

① Basic salary(基本給 Kihonkyu): The base amount of salary paid by the company, not including allowances

② Overtime pay(時間外手当 Jikangai Teate): Pay for overtime work outside of the working hours specified in the employment contract. Calculated based on the following formula: unit price per hour × overtime hours × statutory overtime premium rate of 1.25

③ Commuting allowance(通勤手当 Tsukin Teate): Allowance for transportation costs incurred when commuting

④ Qualification allowance(資格手当Shikaku Teate): Allowance paid when an employee obtains a qualification

⑤ Housing allowance(住居手当 Jyukyo Teate): An allowance in which the company pays a part of the rent or housing loan of the employee

⑥ Family allowance(家族手当 Kazoku Teate): A certain amount of allowance paid to employees who have a spouse or children

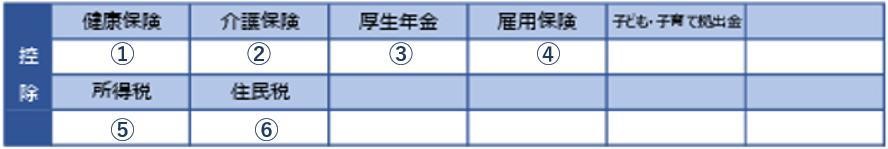

■the total amount of deductions

① Health insurance(健康保険 Kenko Hoken): This insurance is designed to cover part of the medical expenses incurred by the government when receiving treatment for illness, injury, or hospitalization

② Long-term care insurance(介護保険 Kaigo Hoken): This insurance is designed to support those who need nursing care so that they can receive appropriate services

③ Employees’ Pension Insurance(厚生年金 Kousei Nenkin): An insurance system for people to live independently and with peace of mind after retirement

④ Employment insurance(雇用保険 Koyo Hoken): This insurance is designed to stabilize the lives of employees, promote their employment, stabilize their jobs, prevent unemployment, and expand employment opportunities

⑤ Income tax(所得税 Shotoku Zei): A tax on annual personal income

⑥ Inhabitant tax(住民税 Jumin Zei): A tax on services provided by prefectural and municipal governments

I hope that information above is useful for you.

For those who are new to Japan, these terms may be complicated and difficult to understand, but by understanding them one by one, you will be able to work with the correct knowledge of what taxes and insurance premiums you are paying.